News & Insights

- 20 August 2020

- cash flow management|fintechsg|invoice financing|sgsmes|SME financing

Benefits of Invoice Financing

- 13 August 2020

- alternative investing|fintech|fintechsg|HNWI|p2b investing|p2p investing|portfolio diversification

Investing in SME lending as passive income

- 29 July 2020

- cash flow|fintech|fintech sg|invoice financing|receivables financing|Singapore SME|working capital

What is Invoice Financing?

- 21 July 2020

- fintech|fintech lending|fintech sg|p2p investing

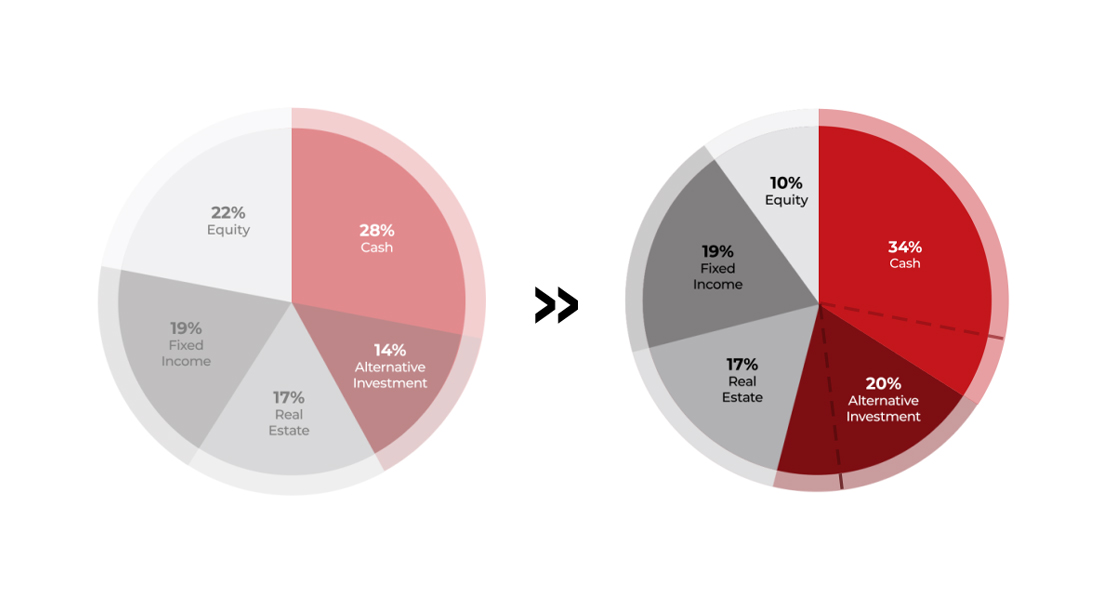

Should You Be Optimizing Asset Allocation & Portfolio Returns

- 1 July 2020

- alternative investing|Covid-19|p2p investing|P2P Lending|Singapore SME

COVID-19: How Should Investors React Now?

- 17 January 2020

- business financing|Singapore SME|SME financing

Validus: 5 ways to boost your business in the new year

- 23 December 2019

- business financing|Singapore SME|SME loans

How SMEs can prepare for the festive season

- 26 September 2019

- p2b lending|P2P Lending|Singapore SME|small business loans|SME financing

The Difference Between Good And Bad Business Debt

- 7 August 2019

- fintechsg|SME financing|sustainable packaging

TRIA: Growing Sustainably with Earth-Friendly Food Packaging

Download our exclusive SME Financing Economic Impact Study

We’re proud to share the findings of an independent study by Steward Redqueen, on the economic impact of Validus’ business financing activity in Singapore. By empowering SMEs through accessible financing, there was a considerable impact in GDP creation, and job growth across these SMEs in Singapore.

Through this report, we hope to highlight the financing challenges SMEs currently face, drive greater awareness on alternative credit sources available to help fuel SME growth and foster ecosystem collaboration.